ev charger tax credit 2021 california

Free or Reduced Tolls. The Lectron EV Charger surpasses your standard The Lectron EV Charger surpasses your standard factory-issued charger cutting total charge time in half.

Rebates And Tax Credits For Electric Vehicle Charging Stations

For example Colorado offers a 4000 tax credit through 2021 on the purchase of light-duty EVs and Connecticut allows for a reduced biennial vehicle registration fee of 38 for EVs.

. A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. FEDERAL TAX CREDIT 6. The JuiceBox series of home EV chargers is available in three variants 32 amp 77 kW 40 amp 96 kW and 48 amp 115 kW.

Many models listed. Built on the universal J1772. Paying for Your Electric Vehicle and Charger.

MX-30 EV TRIM COMPARISON Premium Plus Starting at 36480 9. One of the reasons you may have gone solar for your home is the Federal Investment Tax Credit ITC commonly known as the Solar Tax Credit. It features an LED display which notifies you of any charging faults and an extra long 18 feet cable to better ensure reachability.

The X5 xDrive is. EV sales should grow to reach approximately 295 of all new car sales in 2030 from an expect roughly 34 in 2021. ChargePoint is providing information on this tax credit only and is not the issuer of the tax credit.

When connected to a Level 3 DC Fast Charger. The Solar Tax Credit gives a dollar-for-dollar tax deduction equal to 26 of a solar energy systems total cost in 2020. Top reasons to drive an Electric Vehicle.

SMUD - Commercial Electric Vehicle Incentive Program. Cheaper to Chargethan to. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations.

NEMA 14-50 EV charger SAE J1772 compliant is rugged and robust with. The least-expensive 2021 Chevrolet Bolt EV is the 2021 Chevrolet Bolt EV LT 4dr Hatchback electric DD. In 2020 the number of EV or electric vehicles decreased to 322000 from 2019.

Below is our latest long-term forecast for new electric vehicle BEV and PHEV sales in the US through 2030. Grab IRS form 8911 or use our handy guide to get your credit. Get a federal tax credit of up to 7500 for purchasing an all.

The Central Coast Incentive Project offers rebates of up to 6500 per Level 2 Charger and up to 80000 per DC Fast Charger. The US Federal Tax Credit gives individuals 30 off a ChargePoint Home Electric Vehicle charging station plus installation costs up to 1000. In 2019 around 329000 electric vehicles were sold according to the US.

Up to 7500 Back for Driving an EV. First decide on the car you want and find out if the automaker has EV tax credits available for buyers. Analysis of the Electrify America Q3 2021 Report to California Air Resources Board reveals an average utilization rate of their DC fast charger highway corridor and urban locations of 48.

Electric Vehicle Tax Credit For 2021. Just buy and install by December 31 2021 then claim the credit on your federal tax return. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles.

Bose Premium Audio w 12 Speakers. Enjoyed by thousands of satisfied EV drivers JuiceBox delivers all the safety and smart charging features you need to make home charging convenient reliable and cost-effective. JuiceBox Smart EV Charger.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. SAVINGS AND TAX CREDIT. Claiming your EV federal tax credit is a fairly straightforward process.

This would also see sales increase to 47 million from a little more than 500000 in 2021. The Federal ITC makes solar energy more affordable for homes and businesses to go solar. The exceptions are Tesla and General Motors.

Depending on the county in which they live residents can take advantage of rebates ranging. However the 2020 electric car market share increased some. There is a federal tax credit of up to 7500 available for most electric cars in 2021.

Now on the market. SMUD - Commercial Fleet Pilot Program. Current EV tax credits top out at 7500.

In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020. The 2019 and 2021 Audi e-Tron also qualifies. 360 o View Monitor 10.

Ford Is About to Start Building Affordable EVs Before jumping into whether the 2021 Ford Mustang Mach-E is eligible for EV tax credits lets talk about what these credits actually are. Rear View Monitor with dynamic lines 11. This is just one of the findings and data points from the just released EVAdoption report California EV Charging Network Utilization.

EV Charging TOU. The tax credit now expires on December 31 2021. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure.

FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED. SDGE - Champions for Clean Air Program. The 330e has a reduced credit of 5836.

Will there be a federal tax credit for electric cars in 2021. Dakota Electric also offers a rebate of up to 500 to install a Level 1 or Level 2 charger. Higher upfront cost is typically.

Rebates and registration fee reductions designed to promote EV adoption. The 2021 Volkswagen ID4 First Pro and Pro S versions qualify. To qualify you must be a site owner or their authorized agent with a Site Verification Form and be a business nonprofit California Native American Tribe or a public or government entity.

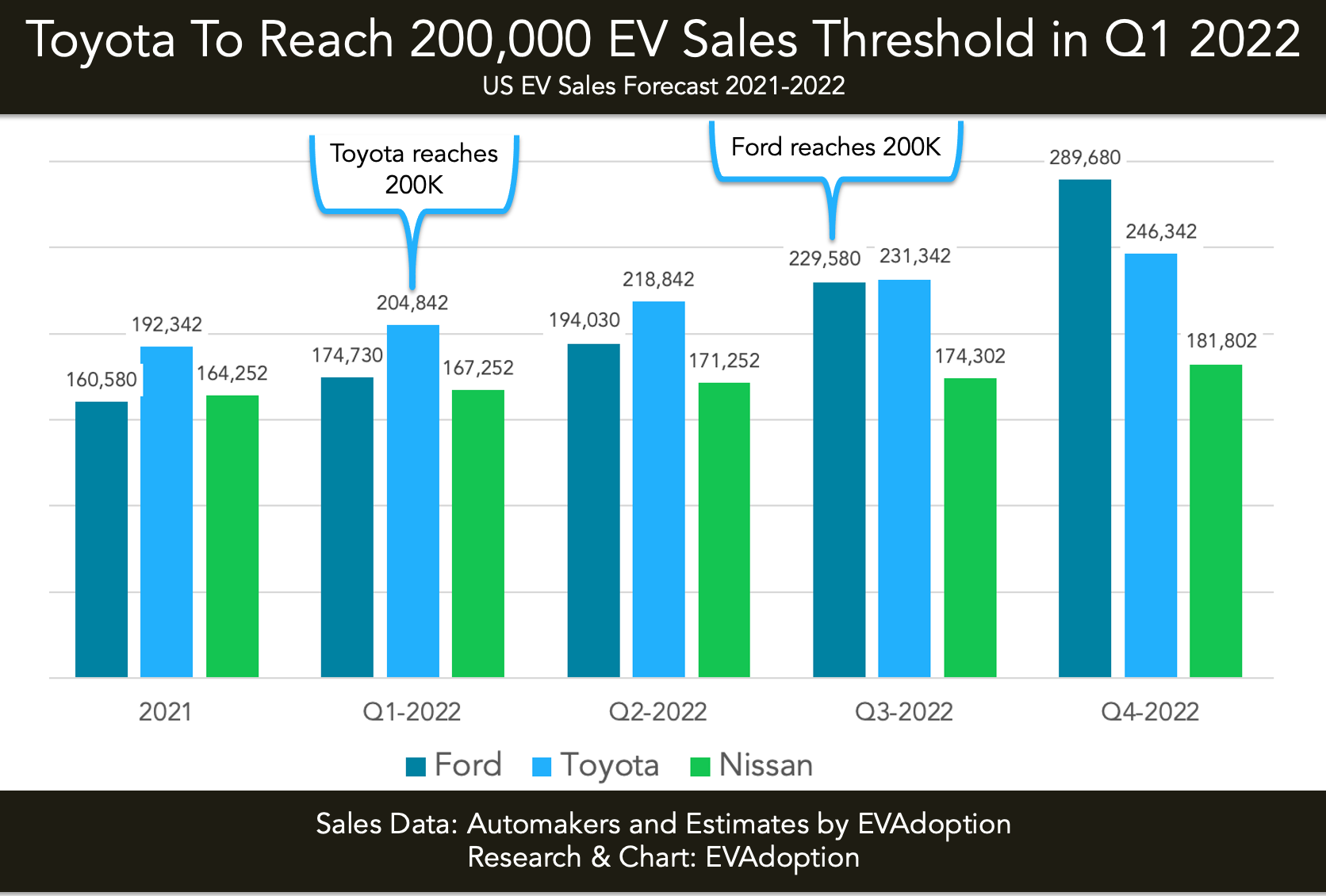

As noted above after the automaker has sold 200000 vehicles the credit is reduced to 50 percent of the original amount. The 2021 RAV4 Prime plug-in hybrid still has the full 7500 tax credit. JuiceBox the best-selling smart home electric JuiceBox the best-selling smart home electric vehicle charger combines performance and value.

Bottom line a Level 2 charger can charge an EV three to 10 times faster than a Level 1 charger can and you can buy good higher-amperage Level 2. Living with your EV. Paid back by 50000 miles.

More stable than gasoline prices. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. Here well outline some the state-based EV charger tax credit and incentive programs in each of these states as of this writing.

As of 2021 California Florida Texas and Washington account for more than half of all the EVs currently driven in the United States. Including destination charge it arrives with a. According to the US.

A few 2021 Mercedes Benz models like the X5 xDrive45e 330e and the 330e xDrive qualify for the credit. Must purchase and install by December 31 2021 and claim the credit on your federal tax return. Department of Energy EVs and plug-in hybrids purchased new after 2010 may be eligible for the federal EV tax creditThe credit maxes out at.

Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

Latest On Tesla Ev Tax Credit February 2022

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Tax Credit For Electric Vehicle Chargers Enel X

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption